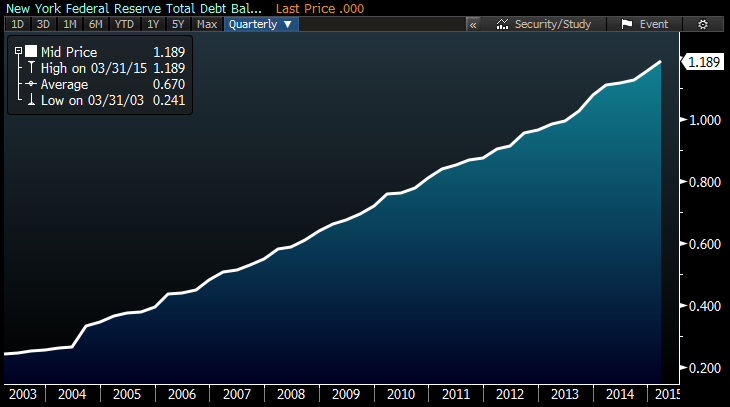

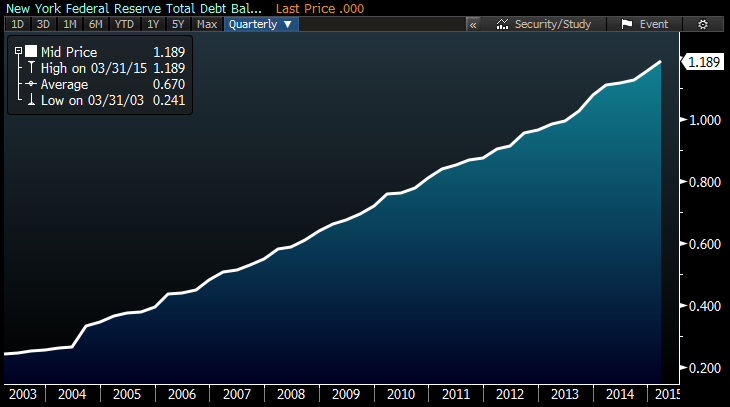

(Jody Shenn) It’s no secret Americans are having trouble paying off their record $1.2 trillion in student loans. What’s less known is that the trend is turning a typically sleepy corner of the bond market into a potential hazard zone.

People who borrowed money for education before the financial crisis are taking longer than forecast to repay their debt, thanks in part to relief programs. That’s creating a risk for holders of securities created by bundling the loans — which are government guaranteed — because the bonds may not be retired by maturity.

As a result, Moody’s Investors Service and Fitch Ratings are considering cutting their rankings on almost $40 billion of securities, possibly dropping top-rated debt to junk status. The potential downgrades threaten to unleash an unusual situation where fundamentally sound bonds with minuscule coupons that reflect their low default risk would need to find new buyers, potentially crushing their prices.

“If this shows up in the junk category, we’re going to compare it to other below investment-grade investments,” said Jason Callan, head of structured products at Columbia Threadneedle Investments, which oversees about $500 billion in assets. “We’d probably find better value in other alternatives.”

Sapping Demand

Bondholders would be faring better if more Americans were actually defaulting, instead of pushing off paying down their debt through a variety of means, given the government guarantees 97 percent of the balances of these loans. While investors see little risk they won’t eventually get all of their money back, the potential rating cuts still threaten to sap demand.

Credit grades still govern many investors’ decisions and, as a result, analysts from Wells Fargo & Co. to JPMorgan Chase & Co. are warning that forced sales by some bondholders are possible.

A Fitch rating “designates the likelihood of the bond to meet its terms, which in every case includes meeting its final maturity payment,” said Michael Dean, a managing director. “The market is going to react how it is going to react.”

Callan said money managers with ratings-based investment guidelines often don’t have to sell downgraded debt, though they may be restricted from adding to their holdings.

Repayment Plans

A 2008 Sallie Mae bond at risk of downgrade illustrates investors’ dilemma. The deal’s amount of loans in repayment periods — when borrowers actually face required bills rather than relief granted because of things like being still in school, doing a fellowship or facing temporary economic hardship — has stalled out at between 60 percent and 70 percent, according to Wells Fargo analysts. Of those, 21 percent were delinquent.

While the default rate fell to 1.36 percent in May from an average of 1.9 percent through March 2013, it appears consumers aren’t paying off their loans as they increasingly use so-called income-driven repayment plans, the analysts wrote in a July 14 report. AnObama administration push has expanded use of those programs, which let borrowers send in smaller amounts over a longer period before their debt eventually gets forgiven.

Wells Fargo analysts John McElravey and Ryan Brinkoetter found that the securities would need to fall either 4.5 cents or 7 cents on the dollar to offer investors yields similar to the spreads of 1.75 percentage point to 2.25 percentage points on low-rated subprime mortgage securities unlikely to suffer losses, depending on how low its rating fell.

Forced Selling

JPMorgan says selling may provide a buying opportunity, while it may be difficult for typical investors in this market to capitalize on it. Those buyers often treat top-rated asset-backed securities as a surrogate for cash.

“Should there be forced selling,” JPMorgan analysts led by Amy Sze wrote in a July 10 report, “we recommend investors take advantage of the potentially very attractive discounts.”

For securities whose ratings have been under review since April, yields have widened about 0.1 percentage point more than other similar debt relative to benchmark rates, according to JPMorgan data. Typical spreads on AAA rated student-loan bonds have increased about 0.2 percentage point, with seven-year notes now at 0.75 percentage point.

Loan Buybacks

The problem is unique to loans issued before the crisis because Congress passed legislation in 2010 that ended government guarantees in favor of direct federal lending for education. Issuance of bonds backed by the debt has since collapsed, with outstanding securities declining to about $170 billion from almost $200 billion in 2008, according to Securities Industry & Financial Markets Association data.

Even though sponsors of bond deals are considering their options to repurchase loans to help transactions pay off by maturity, investors may not get much relief from downgrades. While Moody’s plans to consider the potential for such action, “Aaa securities can’t be contingent on buybacks from sponsors without similar ratings,” said Debashish Chatterjee, a managing director at the firm.

On Wednesday, Moody’s held a conference call for market participants to discuss a planned update to its methodology for the debt. It’s seeking comments through Sept. 7 on the changes proposed last week.

While the final outcome of the rating reviews is hard to predict, “the probability of a downgrade action has increased to more than 50 percent and opened the possibility for a wider set of” bonds than just those under review now being affected, Nomura Holdings Inc. analysts Lea Overby and Radhakrishna Gowrishankara wrote in a July 10 report.

It’s no secret Americans are having trouble paying off their record $1.2 trillion in student loans. What’s less known is that the trend is turning a typically sleepy corner of the bond market into a potential hazard zone.

People who borrowed money for education before the financial crisis are taking longer than forecast to repay their debt, thanks in part to relief programs. That’s creating a risk for holders of securities created by bundling the loans — which are government guaranteed — because the bonds may not be retired by maturity.

As a result, Moody’s Investors Service and Fitch Ratings are considering cutting their rankings on almost $40 billion of securities, possibly dropping top-rated debt to junk status. The potential downgrades threaten to unleash an unusual situation where fundamentally sound bonds with minuscule coupons that reflect their low default risk would need to find new buyers, potentially crushing their prices.

“If this shows up in the junk category, we’re going to compare it to other below investment-grade investments,” said Jason Callan, head of structured products at Columbia Threadneedle Investments, which oversees about $500 billion in assets. “We’d probably find better value in other alternatives.”

Sapping Demand

Bondholders would be faring better if more Americans were actually defaulting, instead of pushing off paying down their debt through a variety of means, given the government guarantees 97 percent of the balances of these loans. While investors see little risk they won’t eventually get all of their money back, the potential rating cuts still threaten to sap demand.

Credit grades still govern many investors’ decisions and, as a result, analysts from Wells Fargo & Co. to JPMorgan Chase & Co. are warning that forced sales by some bondholders are possible.

A Fitch rating “designates the likelihood of the bond to meet its terms, which in every case includes meeting its final maturity payment,” said Michael Dean, a managing director. “The market is going to react how it is going to react.”

Callan said money managers with ratings-based investment guidelines often don’t have to sell downgraded debt, though they may be restricted from adding to their holdings.

Repayment Plans

A 2008 Sallie Mae bond at risk of downgrade illustrates investors’ dilemma. The deal’s amount of loans in repayment periods — when borrowers actually face required bills rather than relief granted because of things like being still in school, doing a fellowship or facing temporary economic hardship — has stalled out at between 60 percent and 70 percent, according to Wells Fargo analysts. Of those, 21 percent were delinquent.

While the default rate fell to 1.36 percent in May from an average of 1.9 percent through March 2013, it appears consumers aren’t paying off their loans as they increasingly use so-called income-driven repayment plans, the analysts wrote in a July 14 report. AnObama administration push has expanded use of those programs, which let borrowers send in smaller amounts over a longer period before their debt eventually gets forgiven.

Wells Fargo analysts John McElravey and Ryan Brinkoetter found that the securities would need to fall either 4.5 cents or 7 cents on the dollar to offer investors yields similar to the spreads of 1.75 percentage point to 2.25 percentage points on low-rated subprime mortgage securities unlikely to suffer losses, depending on how low its rating fell.

Forced Selling

JPMorgan says selling may provide a buying opportunity, while it may be difficult for typical investors in this market to capitalize on it. Those buyers often treat top-rated asset-backed securities as a surrogate for cash.

“Should there be forced selling,” JPMorgan analysts led by Amy Sze wrote in a July 10 report, “we recommend investors take advantage of the potentially very attractive discounts.”

For securities whose ratings have been under review since April, yields have widened about 0.1 percentage point more than other similar debt relative to benchmark rates, according to JPMorgan data. Typical spreads on AAA rated student-loan bonds have increased about 0.2 percentage point, with seven-year notes now at 0.75 percentage point.

Loan Buybacks

The problem is unique to loans issued before the crisis because Congress passed legislation in 2010 that ended government guarantees in favor of direct federal lending for education. Issuance of bonds backed by the debt has since collapsed, with outstanding securities declining to about $170 billion from almost $200 billion in 2008, according to Securities Industry & Financial Markets Association data.

Even though sponsors of bond deals are considering their options to repurchase loans to help transactions pay off by maturity, investors may not get much relief from downgrades. While Moody’s plans to consider the potential for such action, “Aaa securities can’t be contingent on buybacks from sponsors without similar ratings,” said Debashish Chatterjee, a managing director at the firm.

On Wednesday, Moody’s held a conference call for market participants to discuss a planned update to its methodology for the debt. It’s seeking comments through Sept. 7 on the changes proposed last week.

While the final outcome of the rating reviews is hard to predict, “the probability of a downgrade action has increased to more than 50 percent and opened the possibility for a wider set of” bonds than just those under review now being affected, Nomura Holdings Inc. analysts Lea Overby and Radhakrishna Gowrishankara wrote in a July 10 report.