(Louis Cammarosano) Higher Premiums on American Silver Eagles are more a function of lower silver prices than a silver shortage.

Premiums on other silver products, like privately minted silver bars and rounds have not risen to the same extent as premiums on American Silver Eagles and “Junk Silver“

Why Do Premiums on American Silver Eagles Rise?

When one ounce American Silver Eagle coin (ASE) premiums rise, it’s usually in response to an increase in demand. Sales of ASE’s hit records in 2013 and 2014 and are on pace to do so again this year. Premiums rise during sustained surges in ASE sales making it difficult for the U.S. Mint to keep pace with demand.

Lower Silver Prices Cause American Silver Eagle Premiums to Rise

One factor overlooked as to why ASE premiums rise is the falling price of silver that makes the retail price paid per coin rise on a percentage basis much higher than other silver products.

According to the United States Mint (the Mint), Authorized Purchasers (APs) of ASE’s, like Apmex, can purchase ASE’s for $2 dollars per coin over the spot price of silver with a minimum ordering requirement of 25,000 coins.

The Mint’s $2 charge per coin is the same whether the price of silver is $10 or $50 an ounce.

The constant Mint charge of $2 per coin acts to make the premium higher on a percentage basis the lower the silver spot price. For example, a $2 premium on $10 per ounce silver equates to a 20% premium over the spot price of silver on ASEs that AP’s purchase from the Mint; at $20 per ounce a $2 premium per coin equals a 10% premium over the spot price of silver; and at $40 it’s just a 5% premium over the spot price of silver. The higher the price of silver, the lower the premiums APs pay the Mint on ASEs.

Coin Dealer Mark Up Increases the Premium

APs resell their ASE’s to other dealers or sell them directly to the public. In order to make the relationship with the Mint profitable, APs mark up the inventory of ASEs they resell. In times of greater demand, ASEs can be marked up higher per coin than in times of lesser demand or when the Mint can easily meet demand.

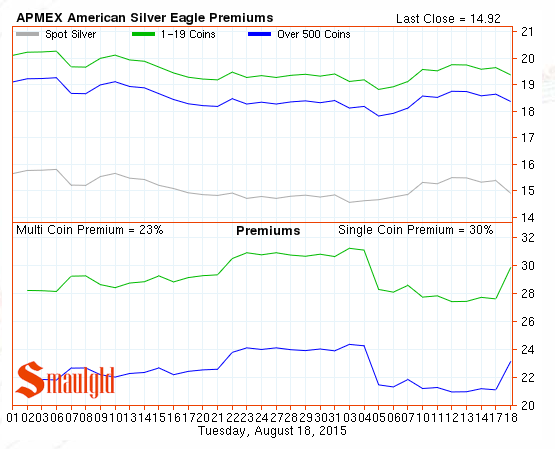

In the chart below (CLICK HERE TO ENLARGE) we show the impact of lower silver prices on ASE premiums. The examples below assume the dealer is an AP and is marking up their inventory from the $2 per coin price they pay to the Mint.

As you can see when the AP buys ASEs at the low price of $10 per ounce, it will pay the Mint $12 per coin or 20% higher per coin than the spot price of silver.

If the AP marks its inventory of ASE’s up just $1 per coin from the $12 it pays the Mint, the sales price will be $13, equalling a hefty 30% premium.

If the AP marks its inventory of ASEs up $2 per coin, the selling price of their ASEs would be $14 or a 40% premium per coin over the spot price of silver.

The impact of the $2 per ASE Mint charge to APs over the spot price of silver becomes less pronounced with higher silver prices.